Property Taxes

The small landowners are the most precious part of a state

Thomas Jefferson

Property Taxes

The small landowners are the most precious part of a state

Thomas Jefferson

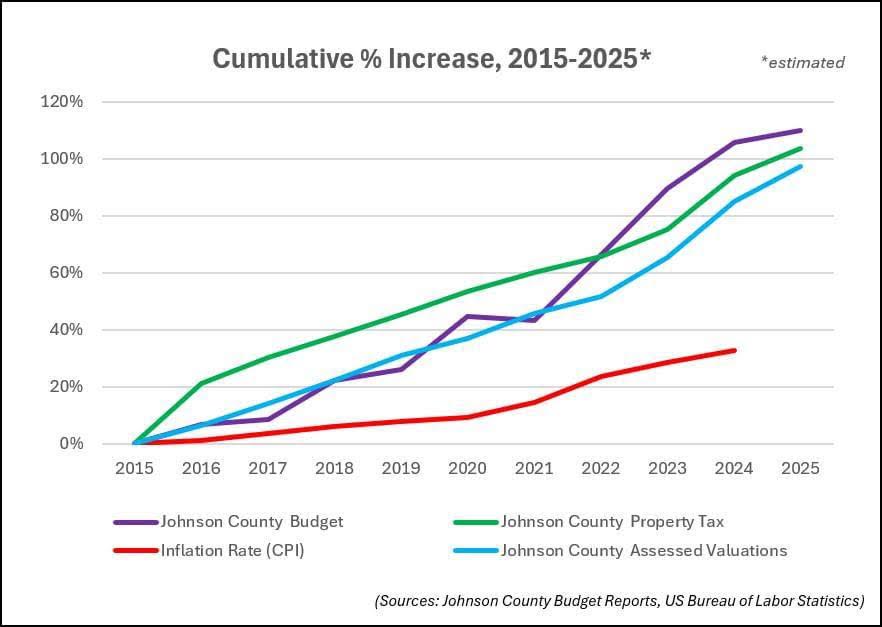

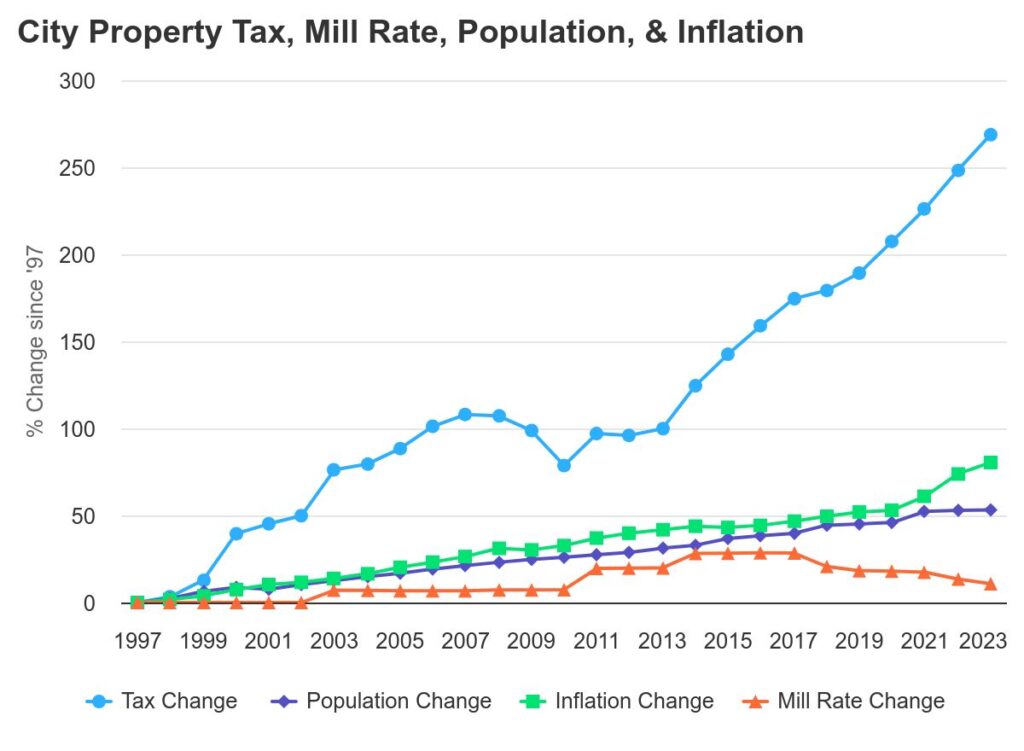

Since 1997, the tax rate for Johnson County Property Taxes has been on a steady rise. The largest increases have been made in the past 10 years.

Despite the County Commission’s claims of lowering the mill levy rate to reduce property taxes, the rapid growth of the tax increase tells a different story (outpacing inflation by 2.5 times and population growth by 5 times).

Once again, we are told one thing, while the facts show a completely different story

Why does the Board of County Commissioners insist they've "lowered" the mill levy while simultaneously promoting new high-density projects that inflate property values, appraisals, and, ultimately, increase YOUR property taxes?

Where do your property taxes go?

Join US

Get up to date information on our projects

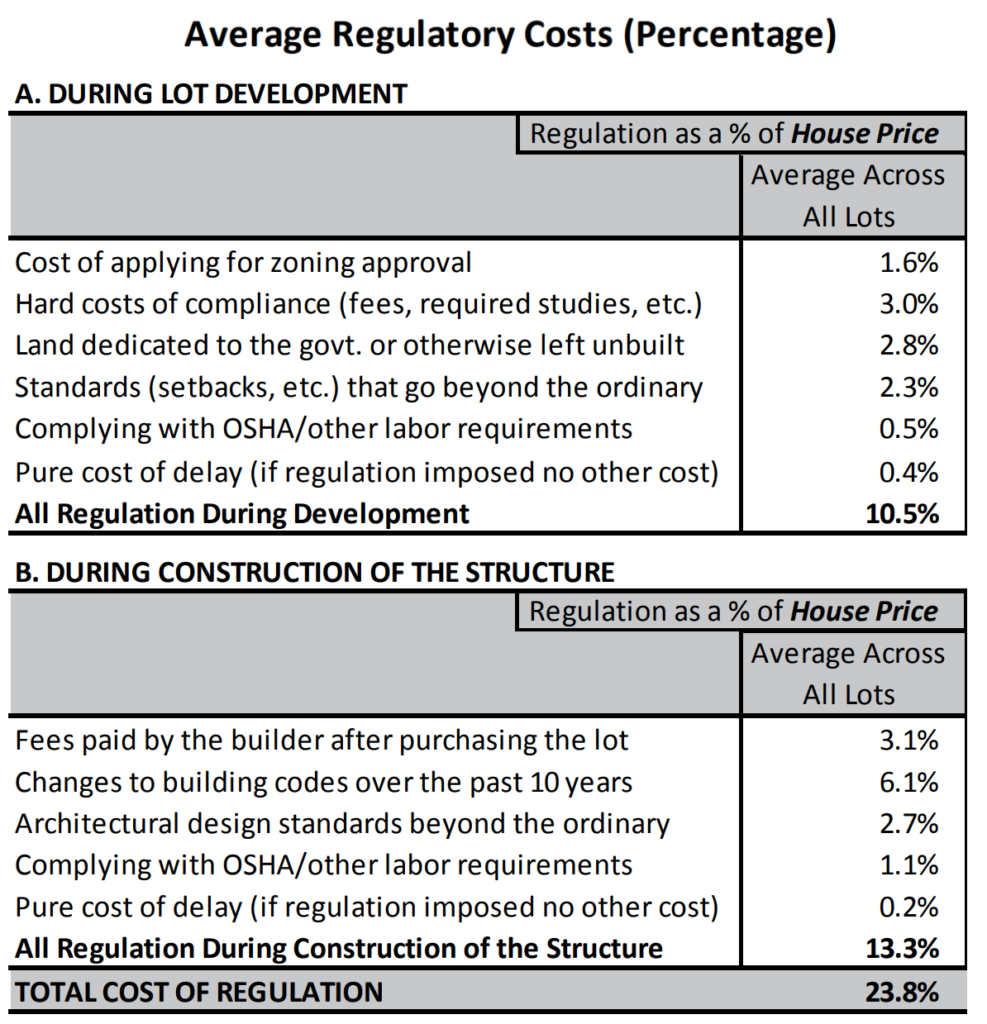

Why Are New Homes So Expensive?

Did you know that as much as 21% of the cost of buying a new single family home goes to fees and regulations?

Catagories | Avg. Cost in JoCo | % Of Total |

Regulations and Fees | $107,500 | 21.5% |

Land Cost | $75- $150K | 15-30% |

Material Costs | $250 - $500K | 65-80% |

Insurance Costs | $3,000 - $5,000 | 1-2% |

Realtor Fees | $25,000 | 5% |

Financing Costs | $10 - $15K | 2-3% |

Example based on $500,000 House in Johnson County, Overland Park KS

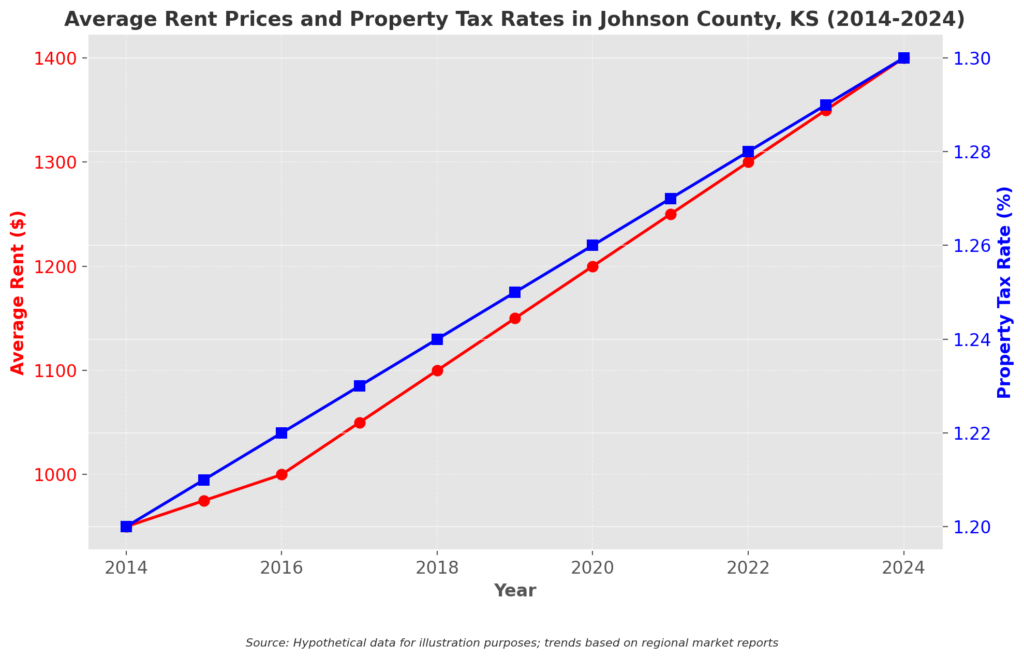

Did you know that when property taxes rise, rents often follow

Did you know that when property taxes rise, rents often follow—even in large apartment complexes? This is because landlords, including those managing large properties, pass along the increased tax expenses to renters, making higher property taxes a direct factor in rising rent costs.